E-Invoicing New Rules 2023: All You Need to Know

September 29, 2023

In August 2023, the Indian government significantly changed how businesses handle their invoices. These changes are notified via the Central Tax Notification Number 10/2023. It notifies that a company or any registered business must use GST e-invoicing if it generates revenues of more than five crore (INR) in a year. This new system aims to make the tax process more organized and smoother.

Consider this article your complete guide to understanding the latest e-invoicing regulations in India. This article details the e-invoicing new rules 2023 and explains what e-invoicing means along with the latest updates from the Indian government. The article also details its implications for retailers and how the new rules mandate retailers to invest in POS and invoicing systems that are compliant with the current GST and e-invoicing laws.

While many people misunderstand e-invoicing for a digital bill, it is a unique system to authenticate business-to-business invoices for further use on the public GST portal. Every invoice produced under the electronic invoicing system will receive an identification number from the Invoice Registration Portal (IRP). This process will be controlled by the GST Network (GSTN).

It is essential to understand that e-invoicing doesn’t mean creating invoices directly on the GST portal. Rather, it involves presenting previously created bills in a uniform style via a shared electronic invoice platform.

This clever process reduces the hassle of reporting because you only need to enter invoice details once.

The Invoice Registration Portal (IRP), managed by the GST Network (GSTN), gives each invoice a unique identification number. This number is like a special code for your invoice. The data from these invoices is immediately transmitted from the IRP to the GST portal and the e-way bill portal in real-time.

It means you don’t have to manually fill in all those details when filing your GSTR-1 returns or generating part A of e-way bills. So, it makes things much easier for businesses, saving time and reducing errors.

The New E-Invoicing Limit of ₹5 Crore is applicable from August 1, 2023.

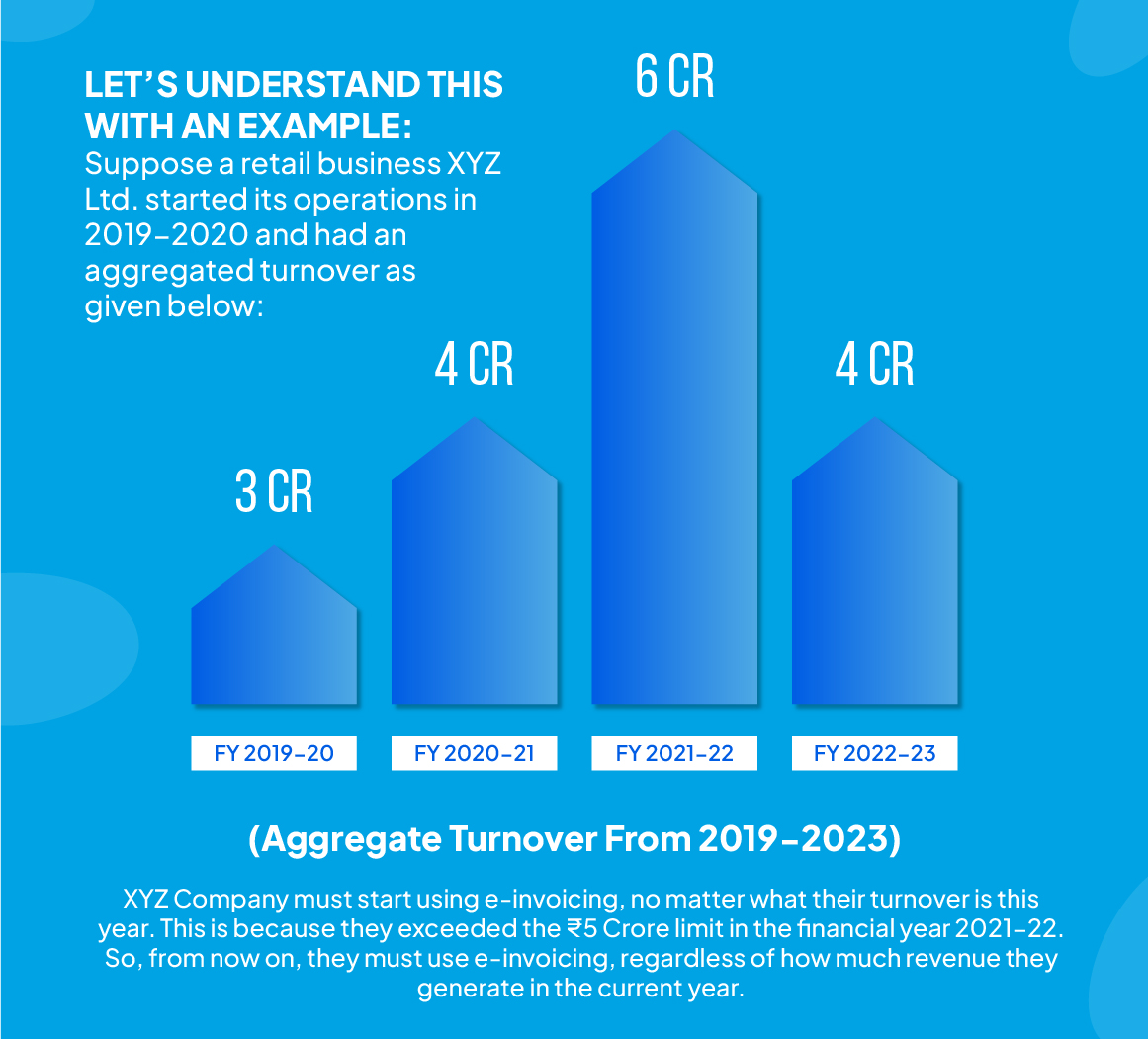

If your business falls under the Goods and Services Tax (GST) regime in India and has achieved a turnover of ₹5 Crores or more in ANY financial year beginning from 2017-18, you must adopt e-invoicing. This means you’ll have to start E-Invoicing for your business transactions.

Starting from the financial year 2022-23 and onwards, you need to follow e-invoicing rules if your turnover exceeds the 5 Crore limit in any financial year from 2017-18 to 2021-22.

E-invoicing applicability is determined by the previous financial year’s turnover. If your turnover crosses the 5 Crore limit in any of those years, you must start filing e-invoices from the beginning of the next financial year, i.e., 2023-2024.

Important Updates to NIC’s e-Invoice Portal (January 2023)

New POS State Code for Transport Services

Now, when you’re using the portal, if you’re dealing with services related to transporting goods, like courier services, you can select a unique code called ’96-Other Country’ for the Place of Supply (POS) state. This code is for situations where the HSN codes are 9965 or 9968.

Document Date Requirement

Another amendment that was issued on NIC’s portal was the document date requirement. It implies that the documents dated October 1, 2021, or after that will only be acceptable. Any paper dated before that will not be accepted on the portal.

Introduction of Error Code 2295

They’ve added a new error message called error code 2295 on the portal. This error pops up when you try to request something already done by someone else. Simply put, you’ll get this error if the Invoice Reference Number (IRN) has already been generated and registered with the GSTN Lookup Portal by another Invoice Registration Portal (IRP). It’s a method to prevent duplication of invoices.

Critical GST Update for Large Businesses (Effective May 1, 2023)

Starting from May 1, 2023, if your company makes at least Rs. 100 crores in a year, there’s a new rule to follow. You must send your tax invoices and credit-debit notes to the Invoice Registration Portal (IRP) within seven days from the date on the invoice. This rule comes from an advisory by the GST Network on April 12 and April 13, 2023.

New Phase of E-Invoicing: Starting August 1, 2023

A new phase of e-invoicing called the sixth phase, came into effect on August 1, 2023. If your business has made 5 Crores or more in any year since 2017-18, you must start using e-invoices.

New Tool for E-Invoice Verification: Now on Google Play Store announced on June 9, 2023.

The GSTN has introduced a handy app called ‘e-Invoice QR Code Verifier,’ you can find it on the Google Play Store. Users can quickly and easily verify the information on electronic invoices with the help of this software. When compared to the data on the e-invoice, it confirms the accuracy of the data encoded in the QR code. If you use an iPhone, there will soon be an iOS version of the app as well!

| The government also made it easier with a new app called ‘e-Invoice QR Code Verifier’ that helps check if invoices are proper. They also added an extra layer of security called Two-Factor Authentication to keep data safe. |

Critical Security Update: Two-Factor Authentication Required from July 15, 2023

Important news for businesses with turnovers exceeding ₹100 Crores! Starting from July 15, 2023, the NIC (National Informatics Centre) made it mandatory to use Two-Factor Authentication when logging into both the e-invoicing and e-way bill systems. This extra layer of security is a must to ensure data safety.

The new e-invoicing rules of 2023 have significant implications for retailers in India. With the limit for e-invoicing being reduced to businesses generating more than INR 5 Crores annually, many retail businesses fall under this category.

Firstly, e-invoicing will make the tax process more organized and smoother. Since invoices are now required to be electronically generated, it will reduce errors due to manual data entry, thereby ensuring accuracy in tax filing.

The introduction of error code 2295 prevents duplication of invoices, ensuring that each Invoice Reference Number (IRN) is unique and has been registered only once with the GSTN Lookup Portal.

The implementation of two-factor authentication from July 15, 2023, provides an additional layer of security, safeguarding the business and customers’ data.

The introduction of the ‘e-Invoice QR Code Verifier’ app allows for easy verification of electronic invoices. This strengthens the transparency and authenticity of transactions made, enhancing trust between retailers and customers.

| The new e-invoicing rules of 2023 necessitate an investment in technology that can handle these changes, making POS systems with e-invoicing capabilities a valuable asset for retailers. |

Given the changes in invoicing rules, retailers should consider investing in a Point of Sale (POS) system with e-invoicing capabilities. Such a system would automate the tax process, reducing the potential for human error, and ensuring compliance with the new rules. This enables merchants to handle invoices efficiently, monitor sales activity, and offer superior customer service.

As India changes how taxes work, there’s a big deal for businesses that make more than ₹5 crore a year. They must use a digital system called GST e-invoicing, which makes paying taxes easier, reduces mistakes, and saves time.

From the start of e-invoicing to the critical updates in 2023, like the new code for where goods are sold (POS state code), the rule about when documents can be dated, and the new error codes, the government is trying to make tax rules clear and make things run smoothly.

Businesses that earn more than 100 crore rupees must submit their invoices for reporting right away. This demonstrates how crucial it is to abide by the GST regulations. The launch of reward schemes like Mera Bill Mera Adhikar for customers who demand and upload GST invoices is another example of the Government of India’s seriousness towards bringing a tax-compliant regime.

All these changes are like a digital revolution for Indian businesses. It means taxes will be more accurate, things will work faster, and everyone can see what’s going on. Following these new rules isn’t just about obeying the law; it’s a chance for businesses to use technology and make finances and taxes easier.

Ensure your POS system has GST-enabled processes for timely taxes and GST compliance along with adherence to new e-invoicing rules!

Retail business inventory refers to furnished goods or ...

June 19, 2024

The guide to e-invoicing for MSME’s provides the crit...

December 29, 2025